where's my unemployment tax refund tracker

You must have your social security number and the exact amount of the refund request as reported on your Connecticut income tax return. Another way is to check your tax transcript if you have an online account with the IRS.

Unemployment Tax Break Refund How To Check Your Irs Transcript For Clues

The IRS began to send out the additional refund checks for tax withheld from unemployment in May.

. This is available under View Tax Records then click the Get Transcript button and choose the federal tax option. The Tax Break Is Only For Those Who Earned Less Than 150000 In Adjusted Gross Income And For Unemployment Insurance Received During The Pandemic In 2020. The Internal Revenue Service doesnt have a separate portal for checking the unemployment compensation tax refunds.

To track your Unemployment tax refunds you need to view your tax transcript. TurboTax cannot track or predict when it will be sent. The agency began sending out refund checks earlier in May and will continue through the summer months.

Online Account allows you to securely access more information about your individual account. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund. The American Rescue Plan Act allows eligible taxpayers to exclude up to 10200 up to 10200 for each spouse if married filing jointly from their gross income which will likely lower the tax liability.

The IRS is recalculating refunds for people whose AGI is 150K or below and who filed before the tax law that changed the amount of unemployment that is taxable on a federal return became effective. The unemployment exemption stimulus checks worth 10200 only applies to individual taxpayers. IRS unemployment refund update.

The only way to see if the IRS processed your refund online is by viewing your tax transcript. 4 weeks after you mailed your return. Enter the whole dollar amount of the refund you requested.

Their incomes must also have been lower than 150000 as of the modified AGI. Check your unemployment refund status by entering the following information to verify your identity. Viewing your IRS account information.

The IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool will not likely provide information on the status of your unemployment tax refund. Check your unemployment refund status using the Wheres My Refund tool like tracking your regular tax refund. The first way to get clues about your refund is to try the IRS online tracker applications.

Will display the status of your refund usually on the most recent tax year refund we have on file for you. The IRS has not provided a way for you to track it so all you can do is wait for the refund to arrive. Check My Refund Status.

After this you should select the 2020 Account Transcript and scan the transactions section for any entries as Refund issued. Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be long Looking for emails or status updates from your e-filing website or software. 24 hours after e-filing.

TAX SEASON 2021. Your employer on the other hand may be eligible for a credit of up to 54 of FUTA taxable wages if. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer.

Individuals in that state though can file an amended state tax return that could potentially fast-track the money. If you received unemployment benefits in 2020 due to the pandemic and paid taxes on those funds you may qualify for a refund from the IRS. They fully paid and paid their state unemployment taxes on time.

Using the IRS Wheres My Refund tool. Refund for unemployment tax break. The refunds are being sent out in batchesstarting with the.

Though the chances of getting live assistance are slim the IRS says you should only call the agency directly if its been 21 days or more. If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an additional refund sometime during the next several months. The 10200 is the amount of income exclusion for single filers not the amount of the refund.

These updated FAQs were released to the public in Fact Sheet 2022-21 PDF March 23 2022. Updated March 23 2022 A1. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday.

Millions of Americans who collected unemployment benefits last year and paid taxes on that money are in line to receive a federal refund from the IRS this year. The agency said at the beginning. From 2021 the FUTA tax rate is 60 and it applies to the first 7000 in annual wages paid per employee.

Click on TSC-IND to reach the Welcome Page. Married couples who file jointly can exclude. Select Check the Status of Your Refund found on the left side of the Welcome Page.

Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. The Department of Labor has not designated their state as a credit. However anything more than that will be taxable.

The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment. Any updates on how to track the IRS unemployment tax refund. Heres how to check online.

22 2022 Published 742 am. Will I receive a 10200 refund. Unemployed workers cant be taxed on that benefit money due to new rules under the American Rescue Plan.

South Dakota House to vote on impeaching attorney general. The Wheres My Refund tool can be accessed hereIf you filed an amended return you can check the Amended Return Status tool. How to track and check its state The tax authority is in the process of sending out tax rebates to over 10 million Americans who incorrectly paid.

Enter the amount of the New York State refund you requested. As for the refunds on the federal benefits the IRS has already indicated that. By Anuradha Garg.

The starting unemployment refund stimulus checks worth 10200 is tax-exempt.

Irs Unemployment Refund Update How To Track And Check Its State As Usa

Irs Tax Law Change Will Trigger Wave Of Refunds Wwlp

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Over 7 Million Americans Could Receive Refund For 10 200 Unemployment Tax Break

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Here S How To Track Your Unemployment Tax Refund From The Irs

Heartbreaking Stories Emerge As Millions Await Tax Refunds Or Stimulus Payments From Irs Fingerlakes1 Com

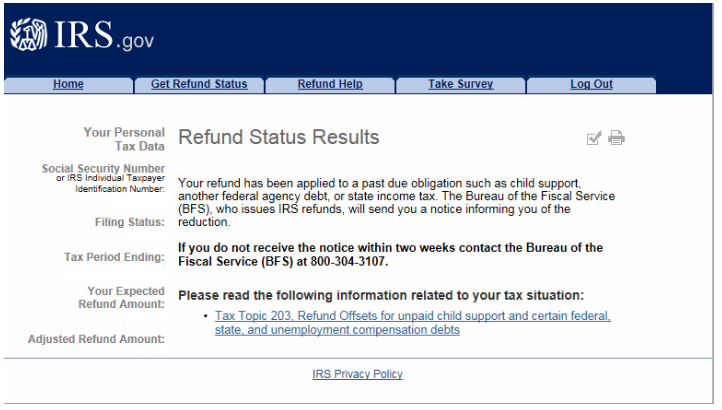

What Does Tax Topic 203 Mean Where S My Refund Tax News Information

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Unemployment Tax Refunds May Not Arrive Until Next Year Warns Irs

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Tax Topic 203 Refund Offset Where S My Refund Tax News Information

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Where S My Refund Where S My Refund Status Bars Disappeared We Have Gotten Many Comments And Messages Regarding The Irs Where S My Refund Tool Having Your Orange Status Bar Disappearing This Has

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System

Irsnews On Twitter Use The Where S My Refund Tool To Start Checking The Status Of Your Refund 24 Hrs After Irs Acknowledges Receipt Of Your E Filed Tax Return You Can Access The